PUBLIC LIMITED COMPANY

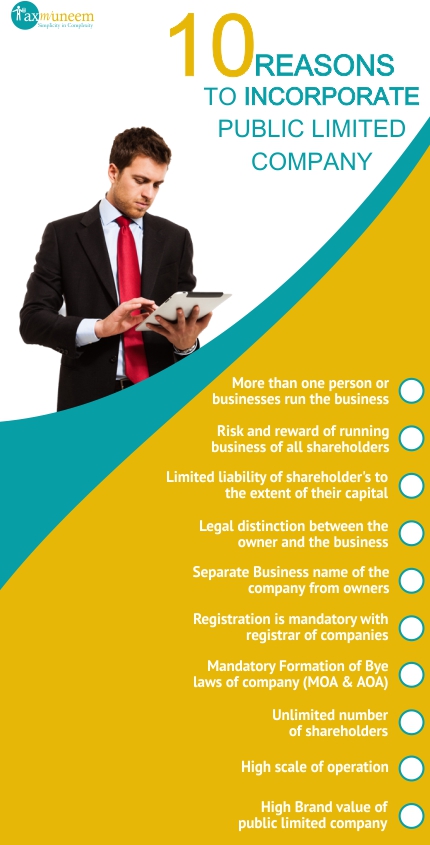

A public limited company is formed under Companies Act, 2013, it limits the liability of shareholders to the extent of their shareholding in the company. There is no restriction on the number of shareholders in public limited company and further the shares of public limited company

can be transferred freely in public.

Public Limited Company has all advantages of private limited company with no restriction on number of shareholders and easy transferability of shares. This type of organization is suitable for large organization or for large scale of operation where the funds to be raised from the public at

large. Further, this type of organization can list their shares on the stock exchange.

Further, since the Public Limited Company has separate legal entity it owns all assets and liability in its own name. It can be sued and it can also sue others in its own name. It can also take various Government registrations and Trademark registration in its own name. The directors or owners involved in the management of the company can be compensated through salary.

We provide comprehensive support service to entrepreneurs by advising them to choose best form of organization and Public Limited Company Registration easily in simple steps.

3 DSC of Directors

3 DIN of Directors

Incorporation with Registrar of Companies

1 Run Name Approval

Customized Memorandum of Association and Article of association.

GST/IEC or any other registration applicable and selected by the user as per package..

Courier charges of sending the original certificate and 1 original MOA & AOA at your address

Any Government Fee or charges payable

Application of PAN and or TAN

Inspection fee payable at the time of visit to the officer if any

Fresh application fee if registration applicable is rejected due any discrepancies in documents of the applicant

Post Incorporation filings of documents

Any registration with government department not selected by the user

Identity and Address Proof of the Applicant directors and subscribers

Copy of PAN card of subscribers (for DIN and registration with govt. department)

Passport size Photographs of subsribers, if applicable

Address Proof and NOC for proposed address of Company.

Consent letter for admission as directors

Any other documents according to selected registration

2 days process for gathering the necessary details and documents

2 days process of DSC application of directors

1 day process for application of DIN

2 days process for preparing documents, MOA & AOA for submission of forms (if customized time depends upon time take by client)

7-9 days process for approval from the date of submission and providing certificate of incorporation

7 days process of PAN application

1 day process for getting documents ready for submission to govt. after receipt of PAN

2 day process for submitting application to government after signing and verification of all documents

1 day process for providing certificate after approval from relevant department and updating its status

PACKAGES

FAQ

A public limited company is form of organization in which more than one person whether natural or artificial come together to earn profits, this type of business limits owners (shareholders) liability to the extent of their shareholding in the company. There is no restriction on the number of shareholders in public limited company and further the shares of public limited company can be transferred freely in public. To define the public company in brief, it has all advantages of private limited company gaining with no restriction on number of shareholders and easy transferability of shares

Any natural person or entity having separate legal identity can become member in the public limited company, but there shall be atleast 7 members and 3 directors to form a public limited company.

A public limited company should have atleast 3 directors and maximum 15 directors.

Yes public limited company registration with registrar of companies is mandatory. The public limited company comes into existence only after its registration with Registrar of companies. To know the process click here

In case of companies the area of operation i.e. business activities, its relation with outsiders, restriction on transfer of shares, directorship and internal mode of operation of company are governed and is written in documents which is called Memorandum of association and Article of association. The Memorandum and Article of association are the basic documents of the company which are mandatory and just like constitution of the company. To know more about Memorandum and association and article of association click here.

There is no upper limit, however minimum paid up capital of Rs500000/- (Five Lac rupees) is required to be introduced in order to incorporation/form public limited company. In the public limited company paid capital of the company is restricted to the extent of authorized capital of the company and in order to enhance the paid up capital, one has to increase the authorized capital of the company.

In public limited company whether it is subscribers initial capital or further issue of shares (except right issue or sweat equity shares) investment is required to be made through proper banking channel separate bank account of the company. Refer section 42 of the companies act, 2013.

Yes, with the certificate of incorporation, Commencement of business and Memorandum of association bank account after complying with other RBI Norms can be opened, there is no need to apply any other registration with government department like VAT or Service Tax etc.. To know more about how to open bank account click here.

No, there is no other registration required for Public Limited Company, only applicable government registrations are mandatory like if sales exceed specified limit of turnover then registration with Goods and Services Tax or shop and establishment as applicable are mandatory. To know about registration with government departments click here.

In public limited company there is no limit on the number of shareholders in the company. Further the shares of a public limited company can be easily transferred without any restrictions.

- Limited Liability: It means that if the company experience financial distress because of normal business activity, the personal assets of shareholders will not be at risk of being seized by creditors.

- Continuity of Existence: Business is not affected by the status of the owner.

- Separate Legal Identity: A company is having a separate legal identity from its shareholders be it a private limited company or public limited company. There it have wide recognition in the commercial industry.

- Minimum number of shareholders required to start the business are only 7.

- More Capital can be raised as there is no limit on the maximum number of shareholders, and thus huge amount of investors capital can be raised either through private placement or public issue.

- Scope of Expansion is higher because easy to raise capital from public, financial institutions and the advantage of limited liability.

- Easy Transferability: The shares of the public limited company can be easily transferred to any other person with just signing a share transfer form and handing over the share certificate.

- Brand Value: Company’s brand value will get increased because people come to know about the company very well.

- Valuation: Since the share price reflects the company’s financial healthiness it would become easy to arrive at a price in case of mergers and acquisitions.

- Equity funding or Bank Finance: This type of business structure are most preferable by angle investors or venture capitalists, they give preferences to this type of business structure and can invest money through equity investment, since it also gives them option of easy transferability of shares. All banks and financial institutions give more preference to advance loans and funding to companies rather than proprietorship and partnership firms.

- No liability in case of frauds by directors: The day to day operations and business decisions in the companies are taken by the board of directors, and if any fraud is made by them, then they will personally liable for the fraud and they will also be liable for prosecution. However there is no shareholders liability in case of fraud by the management of the company if shareholders are not involved.

- Owning Property: A company being separate legal entity can purchase, sale, hold in its name any immovable or moveble properties. Moreover company being a going concern, no shareholder can claim upon the property of the company.

Yes, this type of business structure are most preferable by angle investors or venture capitalists, they give preferences to this type of business structure and can invest money through equity investment, since it also gives them option of easy transferability of shares. All banks and financial institutions give more preference to advance loans and funding to companies rather than proprietorship and partnership firms.

No unlike partnership firm, in case of limited liability partnership and companies name of an existing company cannot be taken by any other person. If anyone tries to take same name it will not be approved by the registrar of companies. So it provide protection of theft of name irrespective of whether trademark of name is taken or not. Further taking name of the company requires approval from the registrar of companies and should company with the guidelines issued from time to time. To know more about such guidelines click here.

No in order to commence the business operations public limited companies are required to obtain commencement of business certificate from the Registrar of Companies.

To know the due date of filing forms with registrar of companies, click here.

To know the forms which are required to filed with registrar of companies, click here.