SOCIETY/TRUST

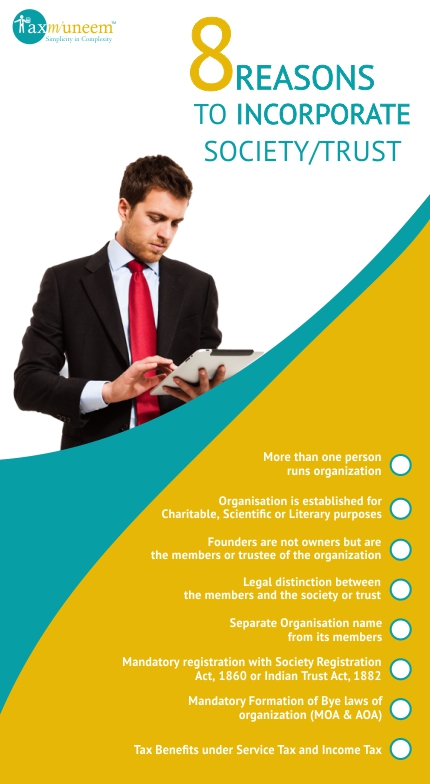

A Society is a voluntary organization formed by Any seven or more persons associated for any Literary, Scientific, or Charitable purpose, may, by subscribing their names to a Memorandum of Association and filing the same with the Registrar of Societies under the Societies Registration Act, 1860.

As per Section 20 of the Societies Registration Act, 1860 the societies which could be registered under the act are following:-.

“Charitable societies, the military orphan funds or societies established at the several presidencies of India, societies established for the promotion of science, literature, or the fine arts for instruction, the diffusion of useful knowledge, the diffusion of political education, the foundation or maintenance of libraries or reading rooms for general use among the members or open to the public, or public museums and galleries of paintings and other works of art, collections of natural history, mechanical and philosophical inventions, instruments, or designs.”

Societies which propose to operate on all India basis should have one member each from at least seven states of the Union of India.

We provide comprehensive support service to socialists by advising them to choose best form of organization and formation of Society or Trust easily in simple steps.

Registration with Registrar of Society/Registrar of Trust

Customized Memorandum of Association and Rules and Regulations/Trust Deed.

Courier charges of sending the original certificate and original MOA & Bye Laws/trust deed at your address.

Any Government Fee or charges payable.

Application of PAN and or TAN.

Fresh application fee if registration applicable is rejected.

Any registration with government department not selected by the user.

Identity and Address Proof of the members/founders

Copy of PAN card of subscriber if available

Passport size Photographs of three members of governing committee signing the MOA, if applicable

Address Proof and NOC for proposed address of Company.

2 days process for gathering the necessary details and documents

2 days process for preparing documents, MOA & Bye Lows for submission (if customized time depends upon time take by client)

30 days process for approval from the date of submission and providing certificate of incorporation.

7 days process of PAN application.

PACKAGES

FAQ

A society is a form of organisation in which seven or more-person associate for any Literary, Scientific, or Charitable purpose, may, by subscribing their names to a Memorandum of association and filing the same with the Registrar of Societies form themselves into a Society under the Societies Registration Act, 1860.

On the other side trust is a form of organization in which 2 or more person associate together for discharge of the charitable and/or religious sentiments of the founder or settlor of the Trust, in a way that ensures public benefit or for the welfare of the members of the family or other relatives, who are dependent on the settlor of the trust, for the proper management and preservation of a property or for any other purpose for the benefit of others for which trust is created.

Society: Charitable societies, the military orphan funds or societies established at the several presidencies of India, societies established for the promotion of science, literature, or the fine arts for instruction, the diffusion of useful knowledge, the diffusion of political education, the foundation or maintenance of libraries or reading rooms for general use among the members or open to the public, or public museums and galleries of paintings and other works of art, collections of natural history, mechanical and philosophical inventions, instruments, or designs.

Trust:- Private Trust which is constituted for the benefit of any family member or other relatives or any other persons who are or within a given time may be, definitely ascertained e.g. Minor beneficial trusts in which trust is created for the taking care of the properties of minor which is automatically dissolved on attaining majority. Private trusts are governed by the Indian Trust Act, further A Private Trust may be created inter vivos or by will. Trust which has been created by will shall be subject to the provisions of Indian Succession Act 1925.

Public trust is constituted for the welfare of public at large like medical, education, relief of poor or advancement of any other object of general public utility. They are essentially a charitable or religious trust which are governed by the General Law. The provisions related to Indian Trusts Act do not apply on Public Trusts. The Indian Trusts Act does not apply to public trusts which can be created by general law. Following are essential characteristics required to create a charitable trust

- a declaration of trust which is binding on settlor,

- setting apart definite property and the settlor depriving himself of the ownership thereof, and

- a statement of the objects for which the property is thereafter to be held, i.e. the beneficiaries.

Public cum Private Trusts are those trusts whose income partly may be applied for public welfare purposes and partly may go to private person or persons.

Society:- Multi State Society and Single State Society.

Trust:– There are no different type of trust on the basis of area of operations.

Societies which propose to operate on all India basis should have one member each from at least seven states of the union of India.

Yes society cannot be created without registration under societies registration act 1860.

Private trust are created either through registration of trust under India Trust Act, 1882 or through will. Public trust are constituted under general law but trust deed/bye law are required to be constituted for registration.

Whether it is mandatory to create memorandum of association/bye laws/trust deed of society or trust?

Yes for the creation of society creation of memorandum of association and rules and regulation is mandatory and is also required to be registered with registrar of societies having jurisdiction over the area in which address of the society falls.

Yes for the creation of trust it is mandatory to create trust deed and bye laws of the trust and its registration.

The name of the society

The objects of the society

The names, addresses and occupations of the governors, council, directors, committee, or other governing body to whom by the rules of the society, the management of its affairs is entrusted.

While deciding the name of society following points shall be kept in mind:

- The Emblems Act,1950 prohibits the use of any name, emblems, official seal etc. as specified in the Act without previous permission of competent authority. It also prohibits the use of the name of national heroes and other names etc. mentioned in the Act. The Societies intending to seek registration are advised to consult this Act also before proposing the name etc. for registration.

- If the proposed name is identical with that by which any other society has been registered or resembles such name which is likely to deceive the public or the member of society, such name may be avoided. Names of all the registered Societies have been put on the website of Industries Department [industries.delhi govt.nic.in] to enable the public and prospective applicants to check the availability of names.

However there are no such restrictions in the registration of trusts.

Society

- Name selection:- Select the name of the society keeping in view the above mentioned prohibitions for name selection.

- Formation of Memorandum of association and Rules and regulations of society.

- Affidavit on non judicial paper from the president or secretary of the society regarding relationship between the subscribers to the memorandum.

- Address proof of the premises to be used as registered office of the society.

- Identity proof of all the desirous persons.

- All the above documents are to be submitted along with fee to the office of registrar of societies having jurisdiction over the area in which proposed address of the society falls.

Trust:

- Creation of trust deed containing name of founders, settlor, beneficiaries (in case of public trust, objectives), governing body of the trust.

- Address proof of the premises to be used as registered office of the society.

- Identity proof of the all the desirous persons.

- Photograph of all the proposed trustee.

- Registration of Trust deed in the presence of registrar of trust in the relevant jurisdiction.

Following points shall be kept in mind while preparing Memorandum and Rules & Regulations of society:-

- It shall contain the name and address of the society, Area of operation and the names, addresses and occupations of the governors, council, directors, committee, or other governing body to whom by the rules of the society, the management of its affairs is entrusted.

- A copy of the rules and regulations of the society, certified to be a correct copy by not less than three of the members of the governing body, shall be filed with the memorandum of association.

- All the signatures of the desirous persons / subscribers given in the clause 5 of the memorandum must be witnessed by an Oath Commissioner, Notary Public

- Member of the Governing Body cannot be outside the list of the desirous persons / subscribers to the memorandum.

- If the rules and regulations of the society are inconsistent with provision of the Societies Registration Act, 1860 they are invalid and mere filing with registering authority for the purpose of registration of society cannot make them valid.

- Memorandum of Association and Rules and Regulations should separately be typed neatly with separate page marking. Good quality durable paper should be used for typing as the documents are for the permanent records.

- At least 4 cm margin must be on the left side and 2.5 cm from right side of each sheet on the thick paper while typing on double space lining and type on one side only.

- Signature of minimum three office bearer are required on each & every page of the Memorandum of Association and rules and regulations of the Society.

Yes, with the certificate of incorporation, and Memorandum of association/trust deed bank account after complying with other RBI Norms can be opened, there is no need to apply any other registration with government department like Goods and Services Tax etc.To know more about how to open bank account click here.

No, only applicable government registrations are mandatory like if sales/Supply of Services exceed specified limit of turnover then registration with Goods and Services Tax Department is mandatory. To know about registration with government departments click here.

Income tax exemption is available to charitable trusts and societies including section 8 companies under companies act 2013. The whole of income of charitable trusts are exempt from income tax u/s 11 of the Income Tax Act, 1961 subject to certain conditions and approval u/s 12A. Moreover, any donation given to a charitable or religious trust is also allowable for deduction to the donor from the taxable income provided trust or society is registered u/s 80G(5) of the Income Tax Act, 1961. Income of Education institutions are also exempt u/s 10 of the Income Tax Act, 1961. Apart from income tax service tax exemption is also allowed to charitable trusts registered u/s 12A of the Income Tax Act, 1961 or who are engaged in education recognized courses. To know more about tax benefits to trust/societies click here.