LIMITED LIABILITY PARTNERSHIP REGISTRATION

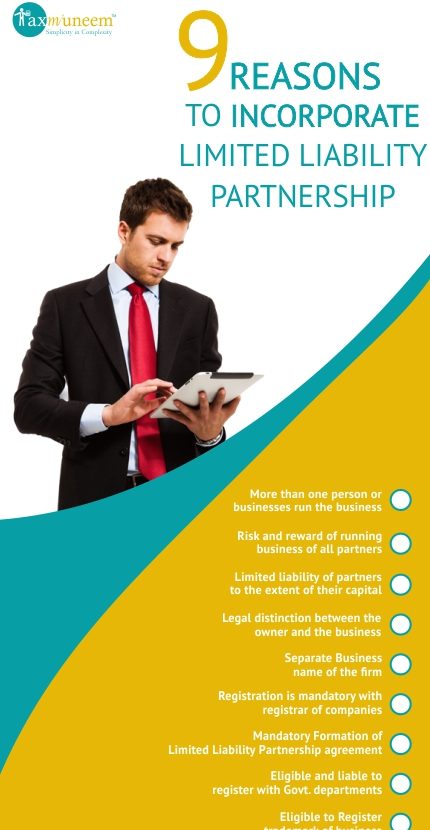

A limited liability partnership (LLP) is a partnership wherein some or all partners (depending on the jurisdiction) may have limited liabilities. It therefore contain elements of partnerships and Companies at the same time. In a LLP, one partner is not responsible or liable for misconduct or negligence of other partner or partners.

The Limited Liability Partnership (LLP) form of business structure is very much suitable for professional and consultancy firm where there is indefinite amount of personal risk. By forming LLPs the risk can be reduced drastically.

The LLP form of business structure combines the benefits of companies and removes the unlimited liability of partnership firm. In this form of organization limited liability and tax benefits are most important benefits.

We help entrepreneurs to form Limited liability partnership easily without any hassle and advising them to draft LLP Agreement properly.

2 DSC of designated partners.

2 DPIN of designated partners.

LLP Incorporation with Registrar of Companies.

1 Run Name Approval.

Standard LLP Agreement or as per the package.

GST/IEC or any other registration applicable and selected by the user as per package.

Courier charges of sending the original certificate and Partnership deed at your address.

Any Government Fee or charges payable.

Fresh application fee if registration applicable is rejected.

Post Incorporation filings of documents (other than LLP Agreement)

Identity and Address Proof of the Applicant partners

Copy of Adhaar Card of Designation Partners.

Copy of PAN card of partners (for DPIN and registration with Govt. departments).

Passport size Photographs of partners, if applicable.

Address Proof and NOC for proposed address of LLP.

Consent letter for admission as designated partners.

Any other documents according to selected registration.

2 day process for gathering the necessary details and documents

1 day process for getting documents ready for submission.

2 day process for submitting application to government after signing and verification of all documents

1 day process for providing certificate after approval from respective department and updating its status.

PACKAGES

FAQ

A limited liability partnership (LLP) is a partnership among more than one person for earning profits in which some or all partners have limited liabilities. It therefore exhibits elements of partnerships and Companies. No other partner shall be liable for mis-conduct of any other partner.

Yes for formation of limited liability partnership registration with registrar to companies is mandatory. To know the process click here

Name reservation: The first step to incorporate Limited liability partnership (LLP) is reservation of name of LLP. Applicant has to file eForm 1, for ascertaining availability and reservation of the name of a LLP business.

Incorporate LLP: After reserving a name, user has to file eForm 2 for incorporating a new Limited Liability Partnership (LLP).

eForm 2 contains the details of LLP proposed to be incorporated, partners’/ designated partners’ details and consent of the partners/ designated partners to act as partners/ designated partners.

LLP Agreement: Execution of LLP Agreement is mandatory as per Section 23 of the Act. LLP Agreement is required to be filed with the registrar in eForm 3 within 30 days of incorporation of LLP.

Yes, an existing partnership firm can be converted into LLP by complying with the Provisions of clause 58 and Schedule II of the LLP Act. Form 17 needs to be filed along with Form 2 for such conversion and incorporation of LLP. In case of conversion of company into LLP complying with the Provisions of clause 58 and Schedule III and IV of the LLP Act. Form 18 needs to be filed with the registrar along with Form 2 for such conversion. However only private limited company or unlisted public company be converted into LLP.

Any private company or unlisted public company can be converted into LLP. However, in this case LLP shall take same name as that of the company at the time of conversion.

Appointment of at least two “Designated Partners” shall be mandatory for all LLPs.

Every LLP shall be required to have atleast two Designated Partners who shall be individuals and at least one of the Designated Partner shall be a resident of India. In case of a LLP in which all the partners are bodies corporate or in which one or more partners are individuals and bodies corporate, at least two individuals who are partners of such LLP or nominees of such bodies corporate shall act as designated partners.

Filing of addendum to Form 2 with Form 2 or addendum to Form 4 with Form 4 is required to be filed if the Total number of designated partners and partners for which the Form is filed exceed 200.

Yes in order to incorporate and govern the limited liability partnership it is mandatory to form a LLP agreement and further it is also mandatory to file any amendment in the agreement with registrar of company in the appropriate forms. As per provisions of the LLP Act, in the absence of agreement as to any matter, the mutual rights and liabilities shall be as provided for under Schedule I to the Act. Therefore, in case any LLP proposes to exclude provisions/requirements of Schedule I to the Act, it would have to enter into an LLP Agreement, specifically excluding applicability of any or all paragraphs of Schedule I

No, only applicable government registrations are mandatory like if sales/supply of services exceed specified limit of turnover then registration with Goods and Services Tax Department is mandatory. To know about registration with government departments click here

Yes, with the certificate of incorporation and LLP agreement bank account after complying with other RBI Norms can be opened, there is no need to apply any other registration with government department like VAT or Service Tax etc.. To know more about how to open bank account click here.

No, only applicable government registrations are mandatory like if sales/Supply of Services exceed specified limit of turnover then registration with Goods and Services Tax or shop and establishment as applicable are mandatory. To know about registration with government departments click here.

The maximum number of partners than can exist in partnership is 10 in case of firm carrying on banking business and in case of any other nature of business the limit is 20. However this limit is governed by companies act and not the Indian Partnership Act, 1932.

- AS MANY OWNERS AS NEEDED:

One of the greatest things of a limited liability partnership is that there is no limit on the amount of owners that can be involved with the business. This is great because it evenly spreads out the amount of liability that each partner can have if something where to go wrong with the business. - MUCH LESS LIABILITY:

Just as the name suggests, limited liability partnerships limit your liability. Since there are multiple owners involved in the business all of the risks of the business are spread out and made much smaller than if a single person was responsible for the business on their own. This generally refers to legal issues, like if the company was sued for any reason. - TAX BENEFITS:

Like partnership firm partners can take salary from the LLP, and unlike companies it does not have to pay any tax on books profit under MAT (115JB of Income Tax Act, 1961). - GREAT FLEXIBILITY:

Flexibility is a defining characteristic of limited liability partnerships. Each partner in the business has the ability to decide how much they want to contribute and how much of a partner they truly want to be in the business. They are also not obligated to participate in business meetings or consultations with anyone that they do not feel the need to. - Easy annual filing with ROC

Unlike companies LLPs are not required to file number of forms with Registrar of companies/Ministry of corporate affairs moreover the cost of filing is much less than the annual filing cost of companies.

- Less Business Credibility: Problem with limited liability partnerships is the fact that other business and many consumers or clients do not see them as a credible business. Corporations gain much more respect and are generally more successful than LLPs.

- Change in Agreement: Every change in LLP agreement is required to intimated to registrar of companies for which appropriate forms a required to be filed. It creates compliance burden although it is a safeguard of interest of all the partners.

- Filing of forms: Unlike partnership firm in LLP designated partners are required to file various forms with registrar of companies.

Yes, other partners with their consent surrender their part of shareholding in other person and can admit it as partner and thus invite investor’s money. Moreover secured and unsecured loan can also be obtained by the firm from investors on interest. Further bank loans can also be brought, the banks gives more credit rating to Limited liability partnerships as compared to normal partnership firms.

No unlike partnership firm, in case of limited liability partnership name of an existing LLP cannot be taken by any other person. If any one tries to take same name it will not be approved by the registrar of companies. So it provide protection of theft of name irrespective of whether trademark of name is taken or not.

LLP is required to file LLP Form 8 (Statement of Account & Solvency) and LLP Form 11 (Annual Return) annually. The ‘Annual Return’ is required to be filed within 60 days of close of the financial year and ‘Statement of Accounts & Solvency’ shall be filed within 30 days from the end of six months of the financial year to which it relates. Every LLP has to maintain uniform financial year ending on 31st March of a year.

Limited Liability Partnership Registration in Delhi

Step by step process for Registration of LLP Company

Step 1.

Reservation of Name through RUN LLP Facility on MCA.

The proposed objective of the LLP must be provided otherwise the application may come for resubmission.

Step 2.

Approval of Name of the LLP by the Department. Department here means Ministry of Corporate Affairs.

Step 3.

Preparing of Forms.

Form FiLLiP- Form for incorporation of LLP along with relevant attachments.

Form 17- In case of application for Conversion of Partnership firm into LLP

Step 4.

Filing of the forms with the MCA.

Step 5.

Resubmission or Approval.

Step 6.

Incorporation of LLP

Step 7.

Preparation of LLP Agreement as per LLP Act, 2008.

Step 8.

Filing of LLP Agreement through Form 3