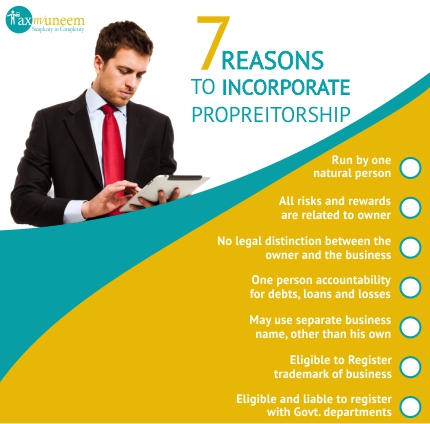

PROPRIETORSHIP

A sole proprietorship, is a type of business entity that is owned and run by one person (being a natural person) and where no legal distinction lies between the owner and the business. The owner directly controls, all the elements and is accountable for the legal compliances and finances of such business which may be debts, loans, loss etc.

The owner can receive all the profits of proprietorship (subject to tax specific to the business) and is responsible for all losses and debts. The assets of the proprietorship are owned by the proprietor only. A sole proprietor is allowed to use a trade name or business name other than his, her or its legal name. The proprietorship firm shall be legally required to register themselves with any Government Department e.g. Goods and Services Tax/Custom/Shop and Establishment Act/MSME Udyog Adhaar etc.

The Government of India does not provide any other mechanism for the Proprietorship Registration. It is only through tax registrations and other and other business registrations that a business is required to have as per the rules and regulations. For instance, GST Registration/ MSME Registration can be obtained in the name of the Proprietor to establish that the Proprietor is operating a business as a sole proprietorship.

We help entrepreneurs to form proprietorship firm or Proprietorship Registration easily without any hassle in a timely and cost effective manner.

GST/MSME/IEC or any other registration applicable and selected by the user.

Courier charges of sending the original certificate at your address.

Any Government Fee or charges payable.

Application of PAN and or TAN, if not available.

Inspection fee if any.

Fresh application fee if registration application rejected

Identity and Address Proof of the Applicant.

Copy of updated Adhaar Card.

Copy of PAN card.

Passport size Photographs, if applicable.

Any other documents according to selected registration.

2 day process for gathering the necessary details and documents

1 day process for getting documents ready for submission.

2 day process for submitting application to government after signing and verification of all documents

1 day process for providing certificate after approval from respective department and updating its status.

PACKAGES

FAQ

A sole proprietorship is a type of business entity that is owned and run by one natural person and in which there is no legal distinction between the owner and the business. The owner of the business is in direct control of all elements and is legally accountable for the finances of such business and this may include debts, loans, loss etc. The Sole Proprietorship is also known as Sole Trader or Sole Partnership.

Yes, a sole proprietor may use a trade name or business name other than his, her or its legal name. But to legally operate business in his own name registration with government department is required in order to open bank account and comply with KYC norms of banks. To know how to open bank account click here.

Yes, a proprietor can apply for registration of his brand name or business name like any other form of business i.e. company, partnership, limited liability partnership (LLP). To know about trademark registration click here.

No, for Proprietorship Registration only applicable government registrations are mandatory like if sales/supply of services exceed specified limit of turnover then registration with Goods and Services Tax Department is mandatory. To know about registration with government departments click here.

EASE OF FORMATION: Proprietorship Registration is much less complicated than starting a formal corporation, the proprietorship can be named after the owner, or a fictitious name can be used to enhance the business’ marketing.

TAX BENEFITS: The owner of a sole proprietorship is not required to file a separate business tax report. Instead, they will list business information and figures within their individual tax return. This can save additional costs on accounting and tax filing. The business will be taxed at the rates applied to personal income, not corporate tax rates.

EMPLOYMENT: Sole proprietorship can hire employees. This can lead to many of the benefits associated with job creation, such as tax breaks. Also, spouses of the business owner can be employed without having to be formally declared as an employee. Married couples can also start a sole proprietorship, though liability can only assumed by one individual.

DECISION MAKING: Control over all business decisions remains in the hands of the owner. The owner can also fully transfer the sole proprietorship at any time as they deem necessary.

LIABILITY: The business owner will be held directly responsible for any losses, debts, or violations coming from the business. For example if the business must pay any debts, these will be satisfied from the owner’s own personal funds. The owner could be sued for nay unlawful acts committed by the employees. This is drastically different from corporations, wherein the members enjoy limited liability (i.e., they cannot be held liable for losses or violations)

TAXES: While there are many tax benefits to sole proprietorship, a main drawback is that the owner must pay self-employment taxes, while in companies/Partnership firm directors/partners can take salaries.

LACK OF CONTINUITY: The business does not continue if the owner becomes deceased or incapacitated, since they are treated as one and the same. Upon the owner’s death, the business is liquidated and becomes part of the owner’s personal estate, to be distributed to beneficiaries. This can result in heavy tax consequences on beneficiaries due to inheritance taxes and estate taxes.

DIFFICULTY IN RAISING CAPITAL: Since the initial funds are usually provided by the owner, it can be difficult to generate capital. Sole proprietorship do not issue shares or other money-generating investments like corporations do

MORE RISK: So, while sole proprietorship do not necessarily create more liabilities, they do expose the business owner to a risk of being sued. Lawsuits can be filed against the business owner for legal violations, as well as to collect any outstanding debts.

Yes, but only as secured and unsecured loans, proprietor cannot invite equity capital of the investors. Further bank loans can also be brought, however the bank a credit rating give more preferences to Companies and Limited liability partnership.