CHANGES IN INCOME TAX RETURN FORMS FOR A Y 2019-20

The CBDT has notified the new Income Tax returns forms for income tax return filing from 1st April, 2019. These new ITR forms are applicable for Financial Year 2018-19. These new Income Tax Return forms have come with more essential changes and more detailed disclosures of taxpayers.

The details regarding changes in Income Tax Return forms are discussed as under:-

Income Tax return Form ITR 1

It is the simplest form for Income Tax Return filing by individual being a resident (other than not ordinarily resident) having total income upto Rs. 50 Lakhs. Aforesaid Individual having income from salaries, One house property (not having any brought forward or carry forward of loss), Other sources (except winning from lottery and not having loss under this head) and agriculture income up to Rs. 5,000 will file this ITR form. This ITR-1 form cannot be filed by Individuals:-

- Who is a director in a company or,

- Who is holding any unlisted equity shares or,

- Who has any brought forward or carry forward of losses.

- Who is assessable for the whole or any part of the income on which tax has been deducted at source in the hands of a person other than the assessee.

- Who has assets located outside india, has signing authority in any account located outside india, has income to be apportioned according to the provisions of section 5A.

- who has claimed tax relief u/s 90 or 90A or tax deduction u/s 91

- Having income of dividend from domestic company exceeding Rs.10 Lac which is chargeable to u/s 115BBDA

- Having income of the nature under section 68, section 69, section 69A, section 69B, section 69C or section 69D.

Income Tax return Form ITR 2

It is to be filed by individuals and HUFs not having income from profits and gains of business or professions and who cannot file ITR 1. This ITR form is also now requires detailed information on the number of days spent in India while declaring the residential status.

Income Tax return Form ITR 3

Income tax return filing in this form to be made by individuals and HUFs, not being person who can file ITR-4 and ITR 2, having income from business or profession and any other source of income. The individual means individual resident, not ordinarily resident or non-resident in India. This form requires detailed information on the number of days spent in India while declaring the residential status. The profit and loss account is also replaced with:-

- Manufacturing account

- Trading account

- Profit and loss account

Income Tax return Form ITR 4 (Sugam)

This return form is to be filed by individuals, HUFs and Firms (other than LLP) being a resident (other than not ordinarily residents) having total income upto Rs 50 lakhs and having income from business and profession which is computed under sec 44AD, 44ADA or 44AE. This ITR form cannot be filed by Individuals:-

- Who is a director in a company or,

- Who is holding any unlisted equity shares or,

- Who has claimed any deductions against income from other sources (other than deduction available against family pension).

- Having loss under this head

- Who is assessable for the whole or any part of the income on which tax has been deducted at source in the hands of a person other than the assessee.

- Who has assets located outside india, has signing authority in any account located outside india, has income to be apportioned according to the provisions of section 5A.

- who has claimed tax relief u/s 90 or 90A or tax deduction u/s 91

- Having income of dividend from domestic company exceeding Rs.10 Lac which is chargeable to u/s 115BBDA

- Who having agriculture income exceeding Rs.5000

Income Tax return Form ITR 5

This return form is to be filed by a persons other than

- Individuals

- HUF

- Company or

- Person filing Form ITR 7

Income Tax return Form ITR 6

This return form is to be filed by companies only but not include those companies claiming exemption under section 11.

Income Tax return Form ITR 7

This return is to be filed by a person including companies required to furnish return under section 139(4A) or 139(4B) or 139(4C) or 139(4D).

Additional Changes has been noticed in ITR forms

- Those assessee who has an income from house property on which tax has been deducted, has to furnish the details of TAN/PAN of tenant for claiming the credit of tax deducted by tenant.

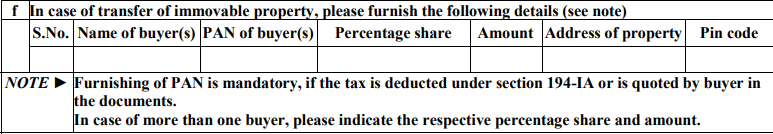

- If the buyer has been deducted tax in respect of sale of any immovable property then it is mandatorily furnish the details of the PAN of the buyer for claiming the TDS.

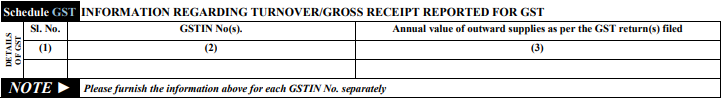

- Assessee who has registered in GST, has to furnish the GST revenue, GSTIN. This disclosure is mandatory for ITR forms 3 to 6.

- For salaried employee, exemption under section 16 has been shown separately with bifurcation and TAN of employer required to be reported in ITR 2 and ITR 3.

Major other additions in ITR Forms

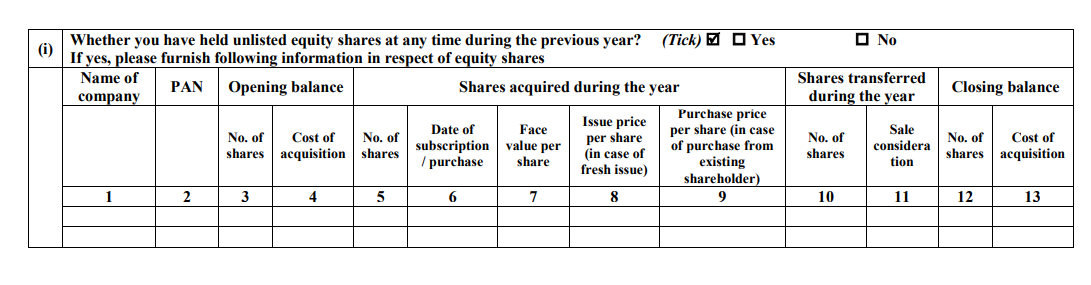

Details of unlisted equity shares (Required in ITR – 2/3/5/7)

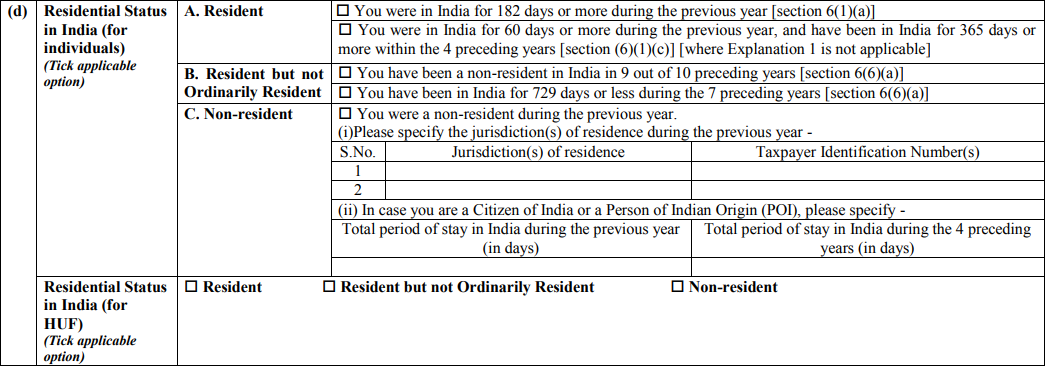

Detailed information regarding residential status (Required in ITR – 2/3)

Detailed information regarding residential status (Required in ITR – 2/3)

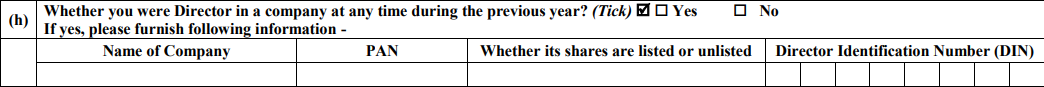

Details of Directorship in any company (Required in ITR 2)

Details of Capital Gain in case of Buyer of immovable property where TDS has been deducted (Required in ITR – 2/3/5/7)

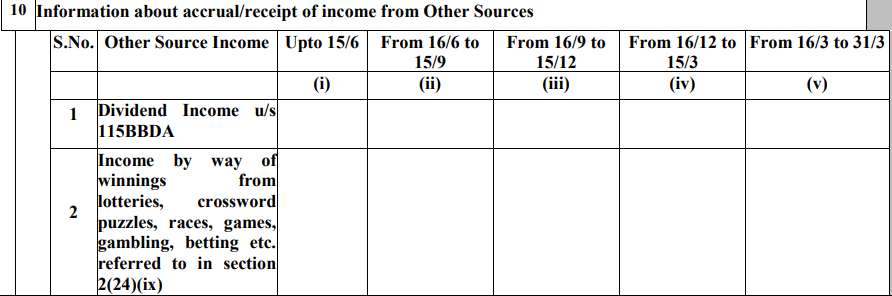

Details of Income from Other sources

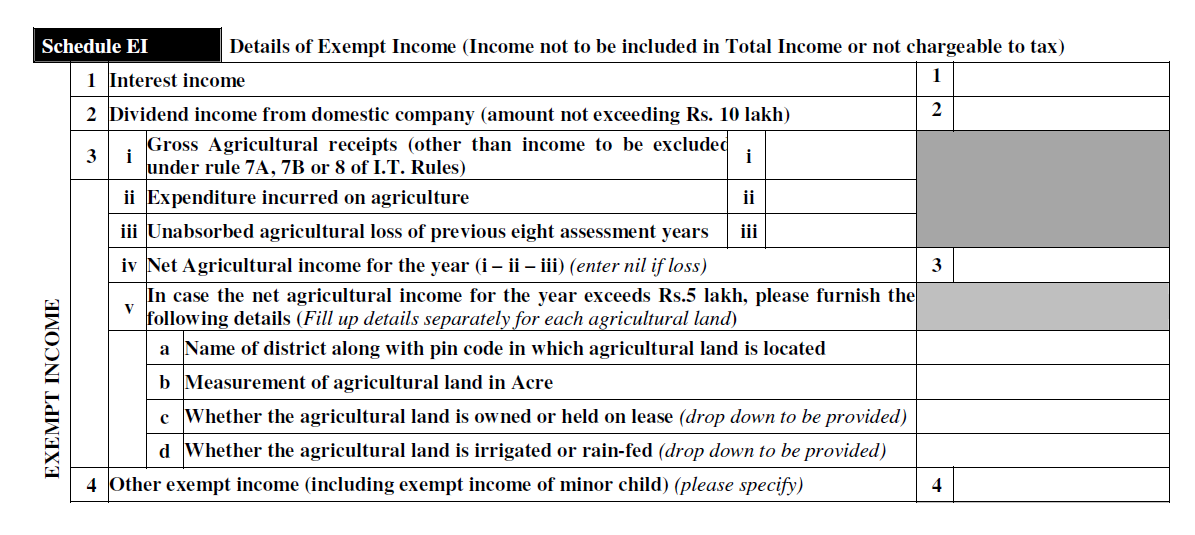

Details of Agriculture Income exceeding Rs.5 Lakh

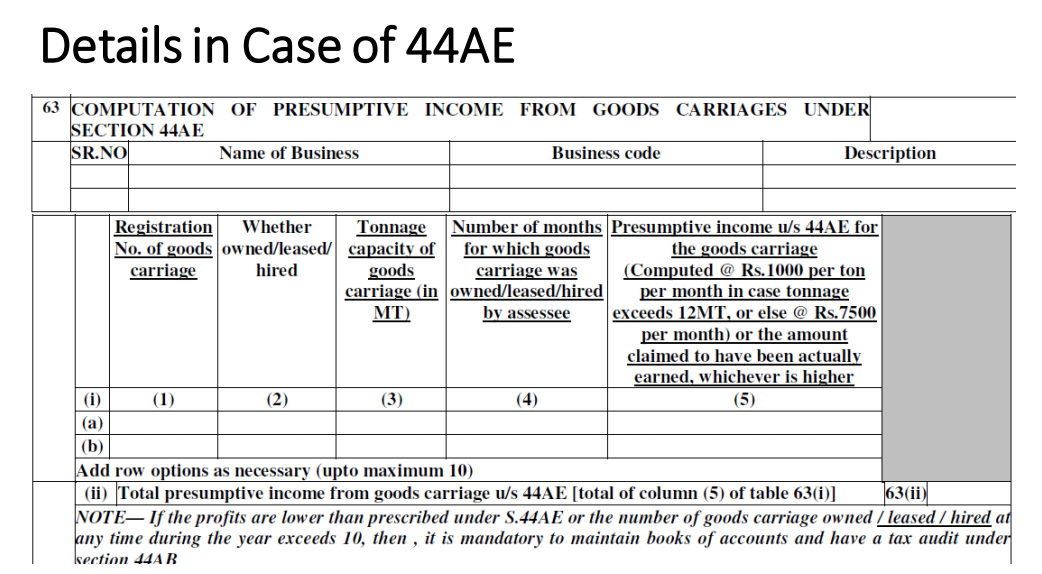

Additional detail in case of income declared u/s 44AE

In case of any help or query related to Income Tax Return Filing, please feel free to contact.